As the old saying goes, all politics is local. While conversations on Africa’s remarkable growth opportunity often focuses on the role that national governments can play, the continent has also seen the emergence of sub-national leaders who are playing their part in driving trade, commerce, and investment.

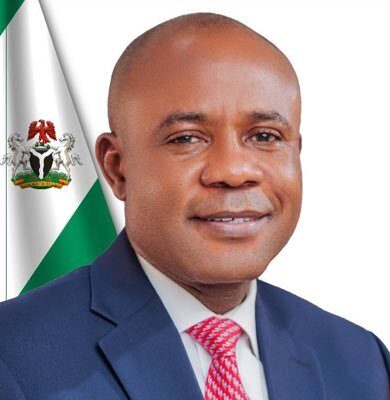

On the margins of this year’s Commonwealth Trade and Investment Summit, CWEIC spoke to HE Dr Peter Mbah, Governor of Nigeria’s Enugu State, about what his administration is doing to improve the state’s trade and investment landscape. Enugu State, a recent Strategic Partner of CWEIC, is working to strengthen its global trade links under Dr Mbah’s leadership. Dr Mbah is a lawyer by background, with qualifications from the University of East London, the Nigerian Law School, Lagos State University, and the University of Oxford; he is also an alumnus of the Chief Executive Programme at Lagos’ prestigious Business School.

A Bold Blueprint for Enugu

“My background is in business, but I’ve had a lifelong passion for public service; there is a fusion. We have built a model for private-public partnership which continues to work effectively for us.”

He has served as the state’s Governor since 2023, and has instituted an ambitious agenda of regulatory simplification and infrastructure development, designed to turn Enugu into a key African trade hub.

“When we campaigned for office, we set out a blueprint for Enugu State which is based on three critical factors. One is to grow the economy from $4.4 billion to $30 billion. The second is to make Enugu the premier destination for business and tourism – and then, of course, to eradicate poverty”, said Mbah, reflecting on the scale of his ambitions.

“As you may have noticed, growing that much in eight years is a tall order. We see a lot of that growth coming from private sector investment and we believe that building business networks will allow us to attract the kind of high net worth investments that will help to catalyse that level of growth in the state.”

Unlocking Opportunities Across the Commonwealth

And what role can the Commonwealth play in driving business to Enugu?

“For us, we are heavy on advocating for common markets, and seeing how we can optimise the value of numbers. Looking at the Commonwealth, with its member states, we see that as a huge market that we can tap into. We have positioned ourselves as a state so that we can take advantage.”

Situated at the northern end of Nigeria’s diverse South-East region, Enugu is one of Nigeria’s smaller states – out of 36 states, it ranks 29th in area and 22nd in population. It sits at a crossroads, between the coastal Niger Delta and the vast forest-savannah which characterises central Nigeria.

Building the Infrastructure for Investment

Traditionally, investment in Nigeria has focused on Lagos, which is home to a large share of the country’s GDP, and the oil-rich states of the Niger Delta. However, Enugu is making strides in changing that landscape.

“Enugu has an international airport and we’re currently building a cargo terminal, so that businesses are able to directly export. We’re going to have the African Quality Assurance Centre in Enugu, so that we have a common facility for quality assurance.”

“We don’t passively wish for investment to happen, we get quite engaged. There are a couple of things that we ensure. We ensure that your investment is safe, we ensure that the process is easy, and we also ensure that the returns are massive.

“We work with you every step of the way, to try and de-risk. When you come into Enugu, as we say, the food is already ready – the investments are curated and prepared in advance. First, we de-risk the technical part. We’ve done the research, we’ve done the deep dives, we’ve done the risk assessments, we’ve built the financial model, so all that businesses need to do is their desktop review to make the final decision.”

“In some places, where we know that investment may attract a huge capital outlay, we put our skin in the game. We can provide businesses with an off-take guarantee, helping you to further de-risk the commercial side of things. It’s not just one opportunity that we’re speaking to, we’re talking about a system.”

With this foundational model in mind, Enugu is working to diversify its economy, attracting investment into a wide variety of sectors.

Focus Sectors: Agriculture, Tourism, and Healthcare

“In the agricultural sector, for example, there are huge opportunities there. We’ve prepared over 300,000 hectares of land-bank – so if you look at the agricultural value chain, we have huge opportunities in the upstream, the midstream, and the downstream. We are scaling up our production, and we are also making sure that we have the processing capacities. We’re not just producing and selling the raw produce; there is also an opportunity to process, package and store this produce.”

“In tourism, we’re developing a couple of tourism sites. Our aim is to attract about two million visitors to Enugu, and so there is a huge opportunity. We’ve commenced the building of a 340-bed, five-star hotel – we didn’t wait for the investors, but today, we have a couple of investors lined up wanting to be part of that.”

“We’re doing the same thing in the healthcare space. We’re building an international hospital; we didn’t have to wait for the investors, we did all of the market assessment and the financial modelling ourselves. Today, we have investors that we’re speaking to, who want to come and take up this investment. This is what we do across different sectors.”

Sustained Investment in Key Enablers

But across the board, it’s Enugu’s proactive model of investor relations that Dr Mbah seems proudest of, which helps to attract investors from a diverse range of sectors.

“We’ve not relaxed in creating the key enablers. We’re paved over a thousand kilometres of roads in the last 20 months, we’ve invested massively in education, healthcare, and security, and continue to do so.”