In 1980, the African middle class numbered around 111 million people. Today, that figure has almost tripled, to 313 million – and by 2060, it is projected to nearly triple again, to over 1.1 billion people.

In the context of the global economy, the rise of the African middle class is one of the stories which will define and shape the 21st century. This growing African middle class will create vast opportunities for businesses of all kinds, providing a ready-made market and shifting Africa’s role in the global economy from export-led growth to a mixed model, in which the continent both creates and consumes finished products, technology, and high-end services.

This emerging story is particularly relevant for the Commonwealth, with its 19 African member states. Thanks to the existing commercial, legal, and cultural ties between the African Commonwealth and members further afield, trade between Commonwealth member states is, on average, about 20 percent cheaper than between non-members. This ‘Commonwealth Advantage’ will ensure that, disproportionately, it is Commonwealth businesses which are helping to provide for Africa’s fast-growing middle class.

Novare’s Bold Footprint Across Sub-Saharan Africa

But how exactly to service the African middle class is a question that is still being answered. One firm which is in the process of helping to write that story is Novare Equity Partners, a CWEIC Strategic Partner, founded in South Africa in October 2000 as an independent investment advisory business and private equity investor.

Since 2006, Novare has expanded across sub-Saharan Africa, building an extensive network and gaining valuable experience into investing on the Africa continent. In particular, Novare has plenty of expertise in managing commercial properties, such as managing 9 malls across three African countries, working alongside some of the most successful retail companies in Africa, which serve as tenants.

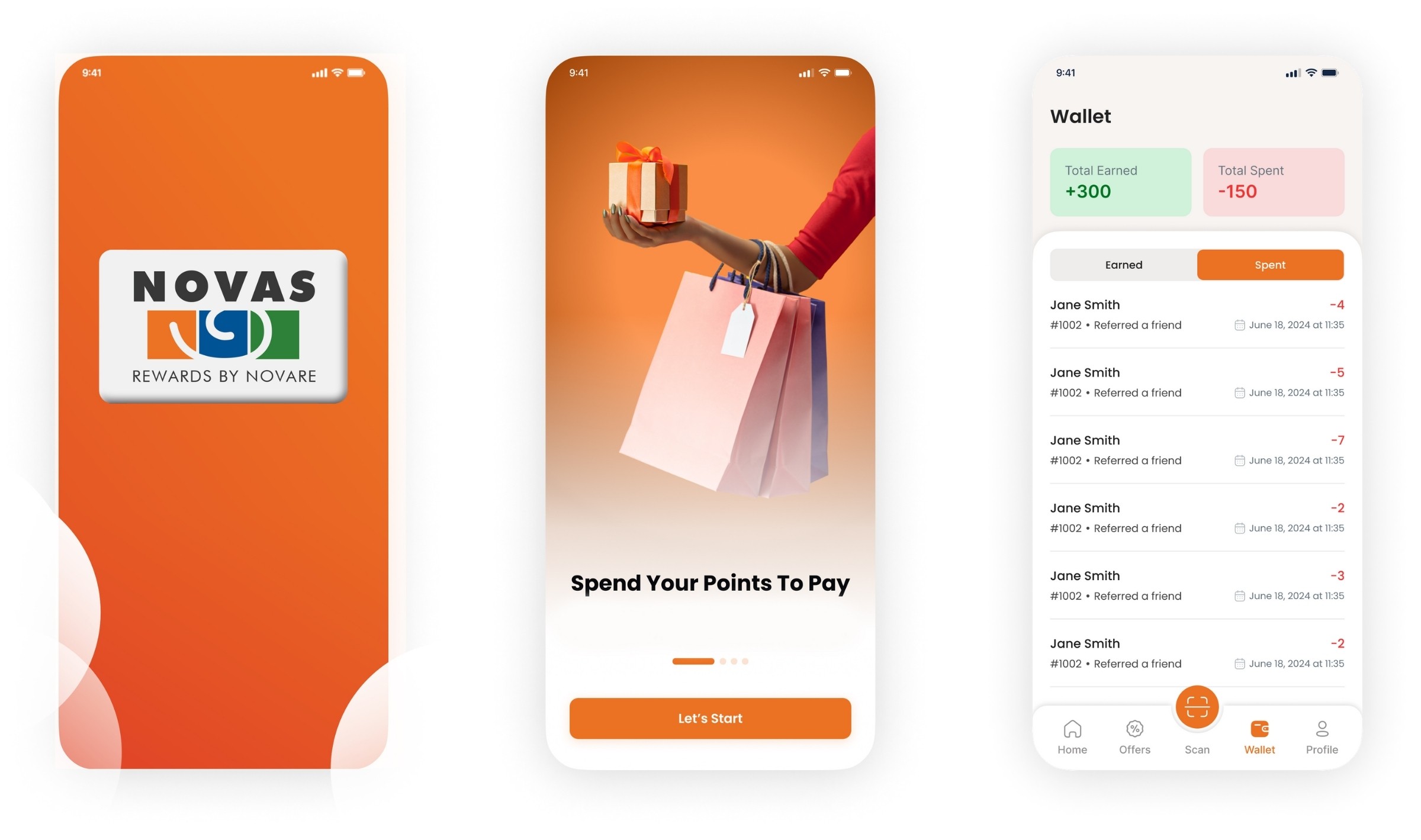

One of Novare’s key innovations is the NOVAS Loyalty Programme, a bespoke system, operated on an App, which rewards customer spending and provides retailers with actionable insights on consumer behaviour. The NOVAS App will allow shoppers to earn loyalty points, access micro-insurance and banking products, and enjoy exclusive offers across participating retailers. Shoppers at Novare Malls can now link their profiles to a smart loyalty platform, unlocking access to NOVAS points, personalised deals, cashback rewards, and exclusive early-bird promotions.

Of course, this new product will also provide unprecedented data on how consumers are spending their money, how preferences are changing, and what kind of financial products they are most interested in.

NOVAS Loyalty: Transforming Shopping Into Data-Driven Engagement

In order to better understand NOVAS, and the African middle class consumer market, we spoke to Marthinus Fourie. Novare’s Head of Fintech Special Projects and Director of the Rewards Programme in Nigeria.

“The NOVAS Loyalty Programme was born out of a very practical observation. In our African malls, the link between retail spending, customer loyalty, and data-driven engagement was largely untapped. Novare’s vision was to create a unified platform that not only rewarded customer spending but also deepened the relationship between retailers and shoppers.”

True to its mission, the NOVAS Loyalty Programme is helping to build a profile of what African middle-class consumers want, and how they are spending their money. While the programme is currently set to be launched in Nigeria, the data, and insights that it can provide could help to identify and shape consumer behaviour on the continent across a range of sectors.

Strategic Rollout and Partnerships

“The programme is currently under construction and will be made available in Nigeria, piloted across Novare’s flagship malls in Lagos and Abuja, with onboarding of tenants well-underway.”

And as the programme sees implementation, how does Novare expect uptake to interface with the growing African middle class?

“Today’s primary users are urban, aspirational middle-class consumers — typically aged 25–45 — with a strong affinity for mobile technology and branded retail experiences. Many are professionals or entrepreneurs, often balancing in-mall shopping with online spending.”

Partnerships Powering the Future of African Retail

The process of rolling out NOVAS in Nigeria has been bolstered by the recent announcement of a strategic partnership between Novare and Access Bank, one of Africa’s leading financial institutions. The new partnership will help to facilitate NOVAS’ rollout, allowing shoppers to access financial products provided by Access Bank, including a digital wallet, loans, insurance, and cards. For retailers, the new partnership with Access Bank will also offer innovative financial tools and improve access to credit for SMEs operating at Novare malls.

But while the NOVAS model is already set to transform the retail experience in Nigeria, it also has the potential to be replicated and scaled across different geographies and sectors.

Unlocking Insights for Africa’s Retail Future

“The data that NOVAS can provide could be valuable for firms looking to enter the African market, or companies which are already operating here, and which want to expand. The African middle class is fast-growing and fast-changing; not many people have a sense of how these consumers are behaving, and what is going to appeal to them.”

“In that regard, the data that NOVAS can generate is second-to-none – and there is no reason that it must stop at malls, either. You could imagine this model working well at casinos, or other types of entertainment venues.”

As the size and affluence of Africa’s middle-class market continues to grow, this kind of insight will be invaluable for Commonwealth businesses looking to seize on the vast opportunities presented by the continent. Given existing links, and the goods and services currently being exported by the Commonwealth’s major economies, closer ties between Commonwealth Africa and the rest of the bloc have the potential to supercharge global growth.

As Marthinus Fourie notes, “The NOVAS loyalty programme is a leading rewards offering creating a three-sided market platform, benefitting shoppers, merchants, and mall management. Collecting data on shopper behaviour will enhance product offerings to consumers, benefit merchants, and create an overall enhanced shopping experience.”

Looking ahead, it is precisely these kinds of innovations and partnerships that will enable Commonwealth businesses to thrive in Africa’s dynamic markets. By harnessing the Commonwealth Advantage and embracing tools that unlock deeper understanding of consumers, member states can help shape a more connected, prosperous, and inclusive global economy.